When start-ups or corporations register their business with CRA on default they are put on filing their HST based on regular method filing. Which is very straightforward. They can claim their Input Tax Credits (ITC) against HST collected. There is another method which is the Quick Method of Accounting or Quick Method. This method requires certain conditions, for example accountants can not use this method, also if your sales are over $400K you can not choose this.

Most of independent contractors are eligible to file under method and this will add more income to their business. The reason is, they will remit 88% of what the HST they have collected and are not allowed to claim any HST that they have paid on purchases, except HST on capital assets, the 12% will be a “Sundry Income”. Tis is win win since most independent consultant do not incur much HST paid.

Consequently, the Quick method can be a source of income for businesses that incur a small amount of taxable expenses since there would be very few ITCs

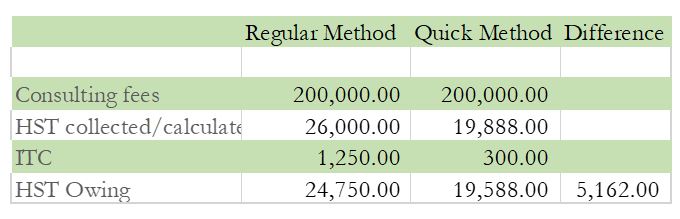

To demonstrate, we can use the example of an independent consultant in Ottawa, Peter, who has elected to use the Quick Method of accounting with respect to the 2018 calendar year. We will assume the following facts;

Furthermore, each year, GST/HST registrants who are on the Quick Method are entitled to a bonus 1% reduction in the remittance rate which is applicable to the first $30,000 of tax-included GST/HST collected minus GST/HST paid.

We were able to save 5,162 in HST and this became a Sundry Income.

It is never too late to change your HST filing method however, this change can be done at the end of filing period. For example, if your filing date is Dec 31. You are not allowed to change the period for the year that went by. What you need can make this change from Jan 1 to end of Feb.

This is fair since CRA doesn’t want businesses wait and see how much HST they have collected and paid and choose the best method. So basically, businesses need to make the choice and stick with it for the year. As soon as I realized that you are paying more in HST you can make the change for the year after.

Just like our example, if Peter starts to see his HST on purchase are exceeding 5,162 per year, he can opt and chose regular method accounting.

This is one of the 1st tasks that we perform for our clients, we assess their HST and show them how much they were overpaying each year. This puts a smile on our clients and they get so excited. Shortly after the smile is wiped out and the client is shocked why his previous advisor did not know this little secret. We respond that he is not alone and a lot of independent consultants are missing this secret. Hence we have dedicated this blog to this cause.

TheNewsOwl.com was not involved in the creation of this content. Information contained on this page is provided by an independent third-party content provider. TheNewsOwl.com makes no warranties or representations in connection therewith.